These Propositions WILL NOT Result in an increase to the current Tax Rate.

PROP B

PROP A

Thanks to efficient financial stewardship, the retirement of old debt, and an increased homestead exemption under new legislation, the district is able to propose both propositions and lower the tax rate by nearly 4 cents, saving the average homeowner approximately $500 per year.

Decrease in the current Tax Rate:

Last year’s tax rate: $1.10

Proposed Tax rate: $1.0638

Estimated Annual Impact on Homeowners:

$500,000 Home: $570 decrease per year

$400,000 Home: $534 decrease per year

$300,000 Home: $497 decrease per year

$200,000 Home: $461 decrease per year

*Estimates include $140,000 Homestead Exemption that is pending voter approval

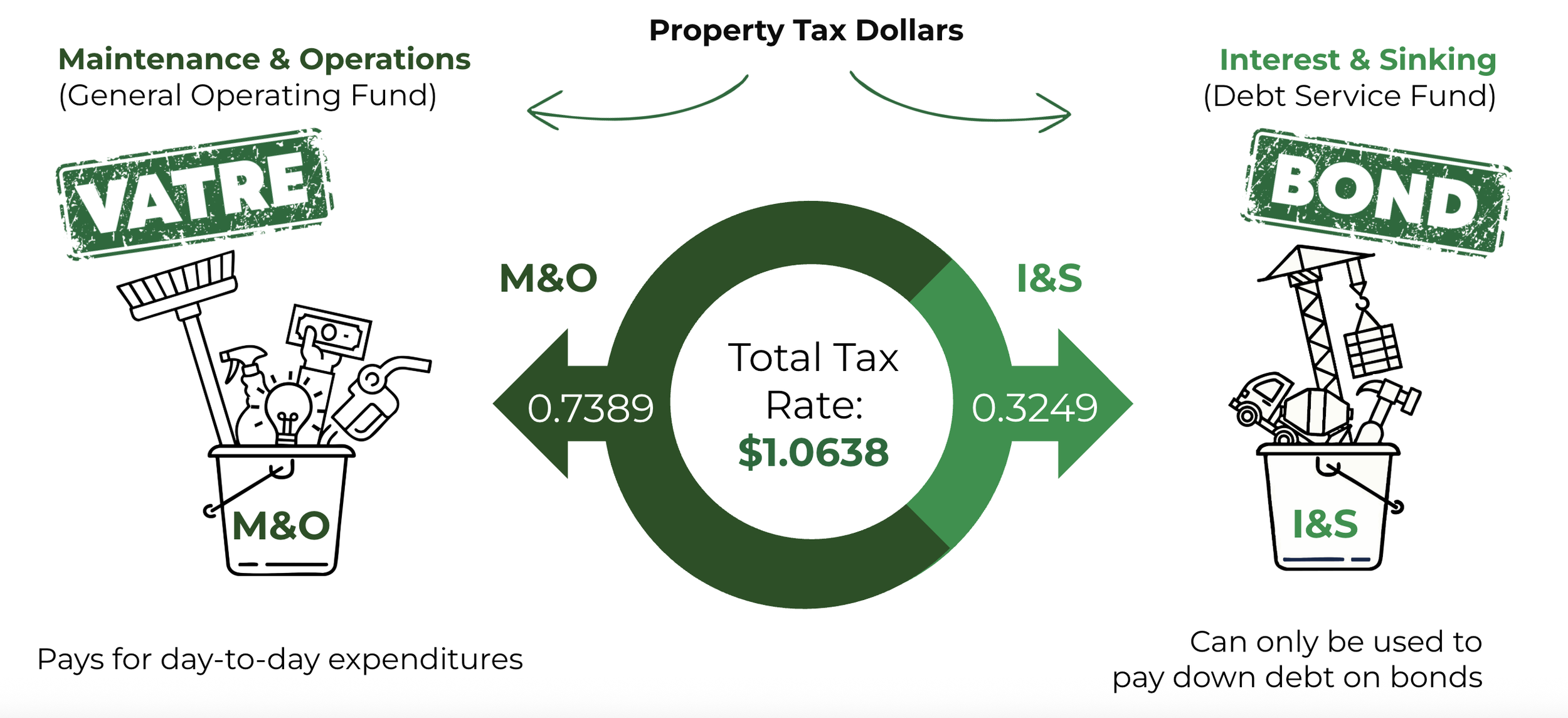

Understanding the

Tax Rate Structure

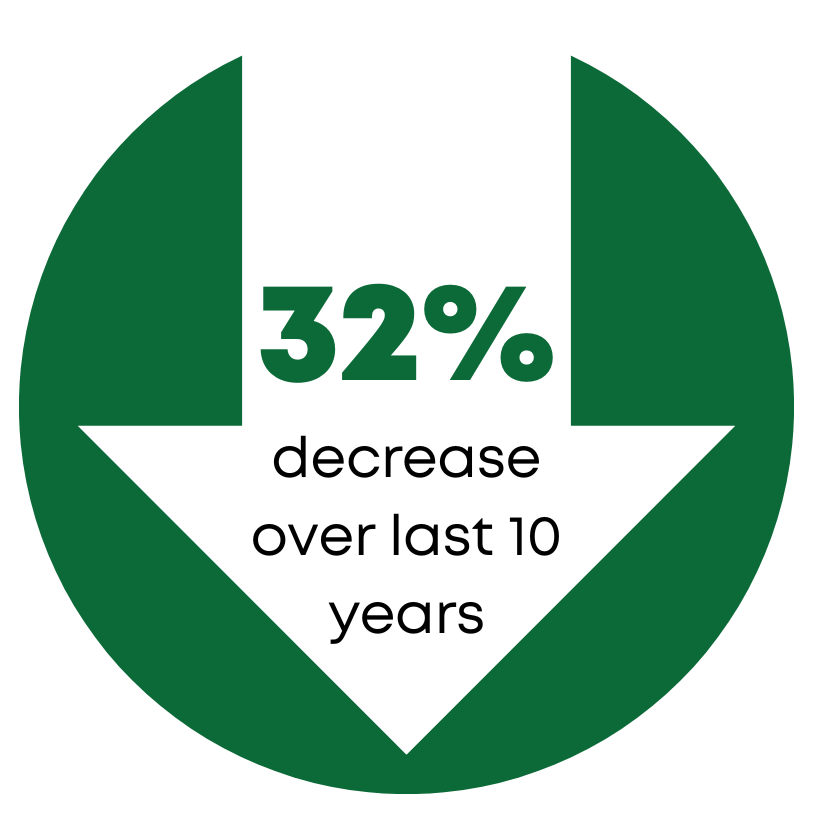

Tax Rate History

How Can Taylor ISD Issue Bonds Without Raising The current Tax Rate?

PAYING DOWN DEBT

Due to the district's responsible approach to paying off debt early, Taylor ISD has achieved outstanding financial ratings and maintained a low tax rate.

FISCAL RESPONSIBILITY

Taylor ISD has effectively used market conditions to restructure debt and secure low interest rates, freeing up resources for educational improvements.